Results of the ICAS Practice Survey 2022

ICAS’ annual survey of the accounting profession finds CAs in resilient mood in the face of stiffening economic headwinds

Download the report:

The annual ICAS Practice Survey provides a snapshot of how sole practitioners and small firms have become accustomed to post-pandemic working practices and what they see as the biggest challenges ahead for what is predicted to be a very difficult year for the UK economy.

Full details – including breakdowns of turnover, debtor days, charge-out rates and fees – are available to subscribers to ICAS Evolve, a bespoke offering for CAs in practice.

Virtually all of our 164 respondents (97%) are either sole practitioners or small firms. Scotland West (35%) proved to have the largest constituency of respondents, while 24% came from the UK outside Scotland.

Cloudbursting

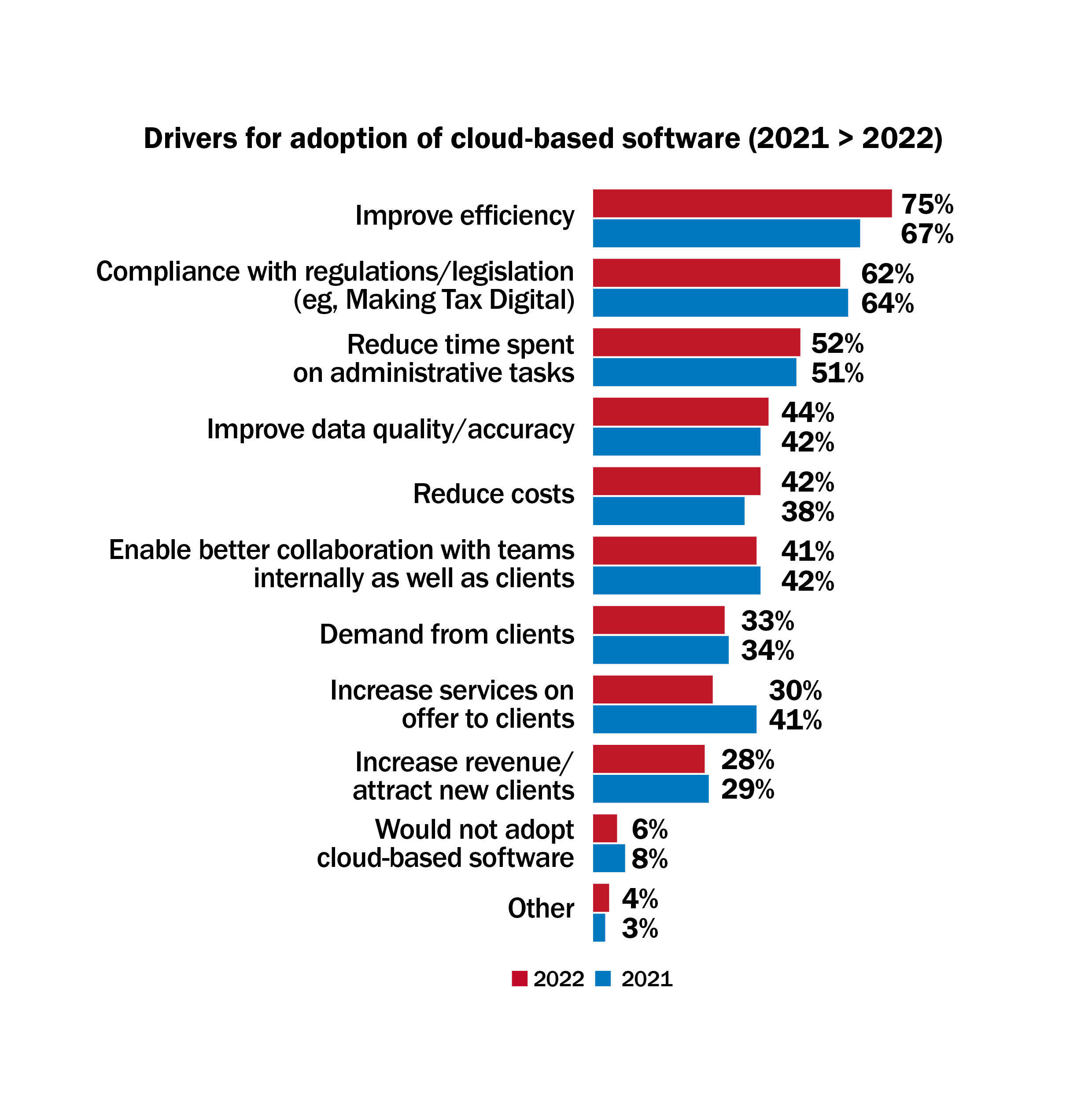

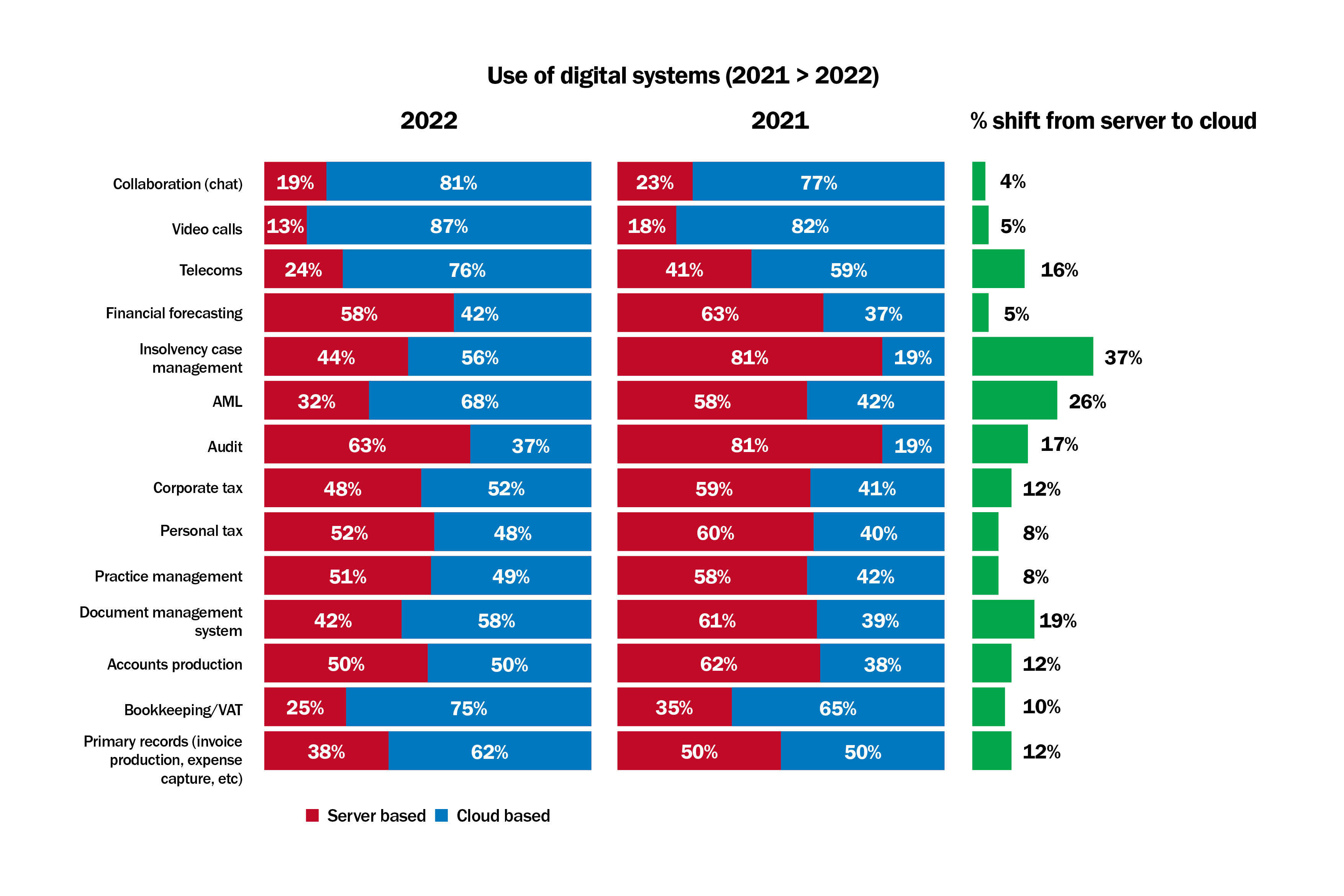

When compared with the 2021 results, there is now greater adoption of cloud-based systems, especially when it comes to insolvency case management where it has increased by 37% on the previous year. The key reasons cited for using the cloud are to improve efficiency (75%), compliance with regulations (62%) and saving time on admin (52%).

Nearly a third said they had experienced challenges when adopting cloud-based software. The two standout issues were the difficulty in replacing or integrating with the current set-up (41%) and behavioural change/organisational culture (34%).

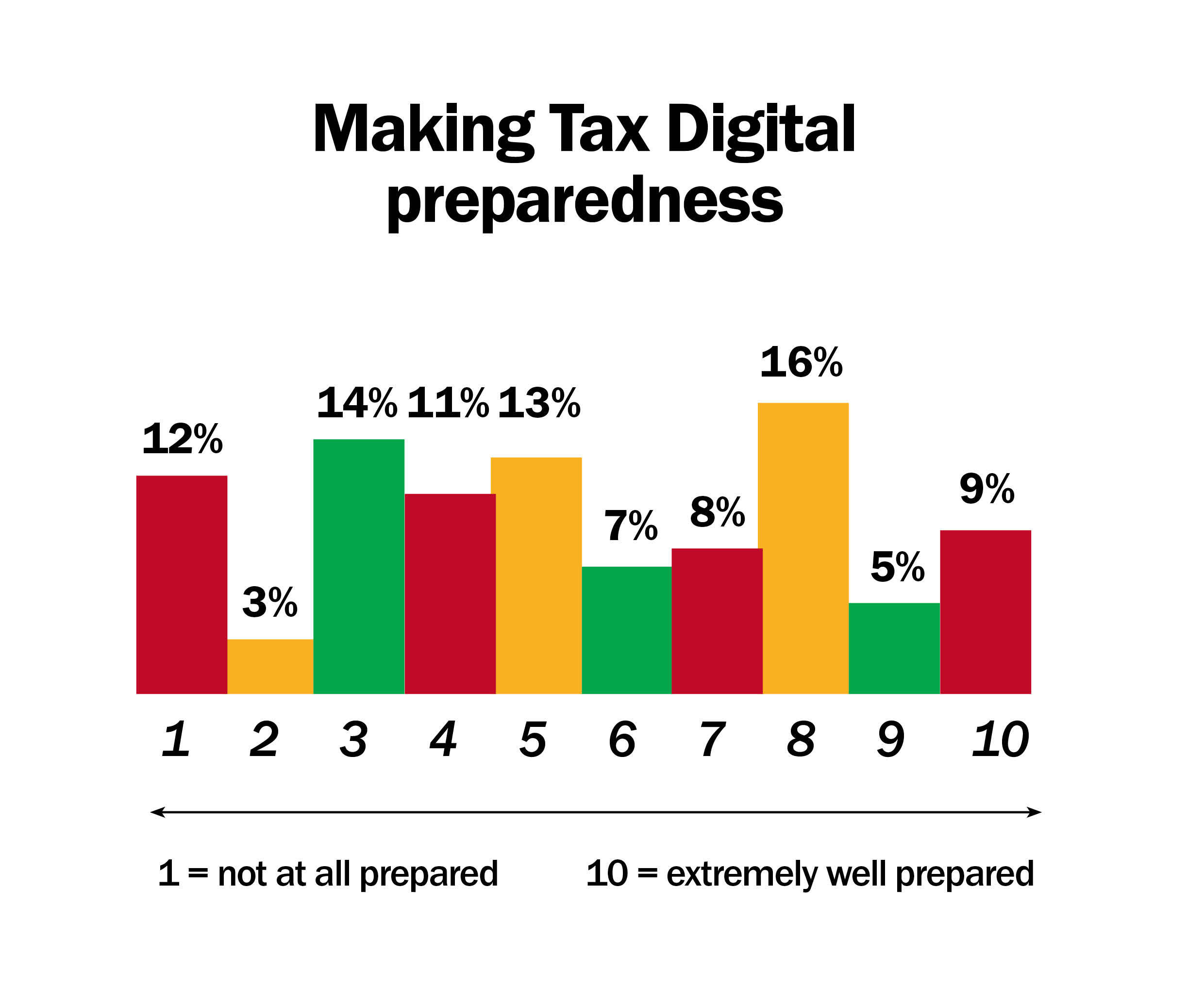

When it comes to preparations for Making Tax Digital, there is a clear difference in line with the size of operation of our respondents. The mean score, on a scale of one (not at all prepared) to 10 (extremely well prepared), is 5.4, but that figure falls to 4.7 for sole practitioners and rises to 6.7 for practices with 10 or more partners. Following on from that, 47% are yet to adopt any MTD software solutions.

Challenges for the next 12 months

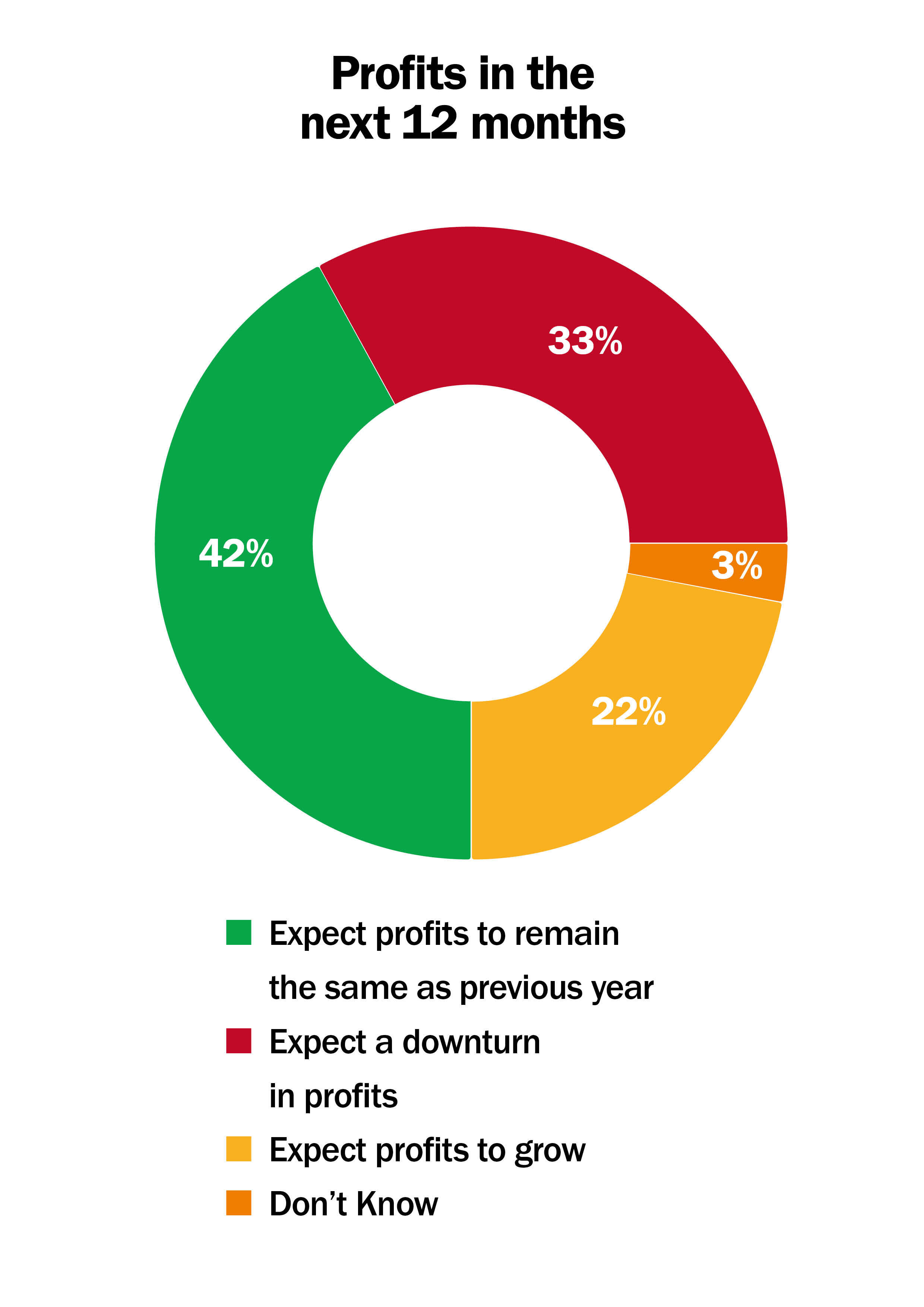

One worrying, but perhaps unsurprising, development is that some 75% said they expect to see either a downturn in profits (33%) or stagnation (42%) over the next 12 months. Some of this can be put down to increased investments in software/tech (50%), training (24%) and recruitment (18%), while staff costs over the past year have been more or less stagnant.

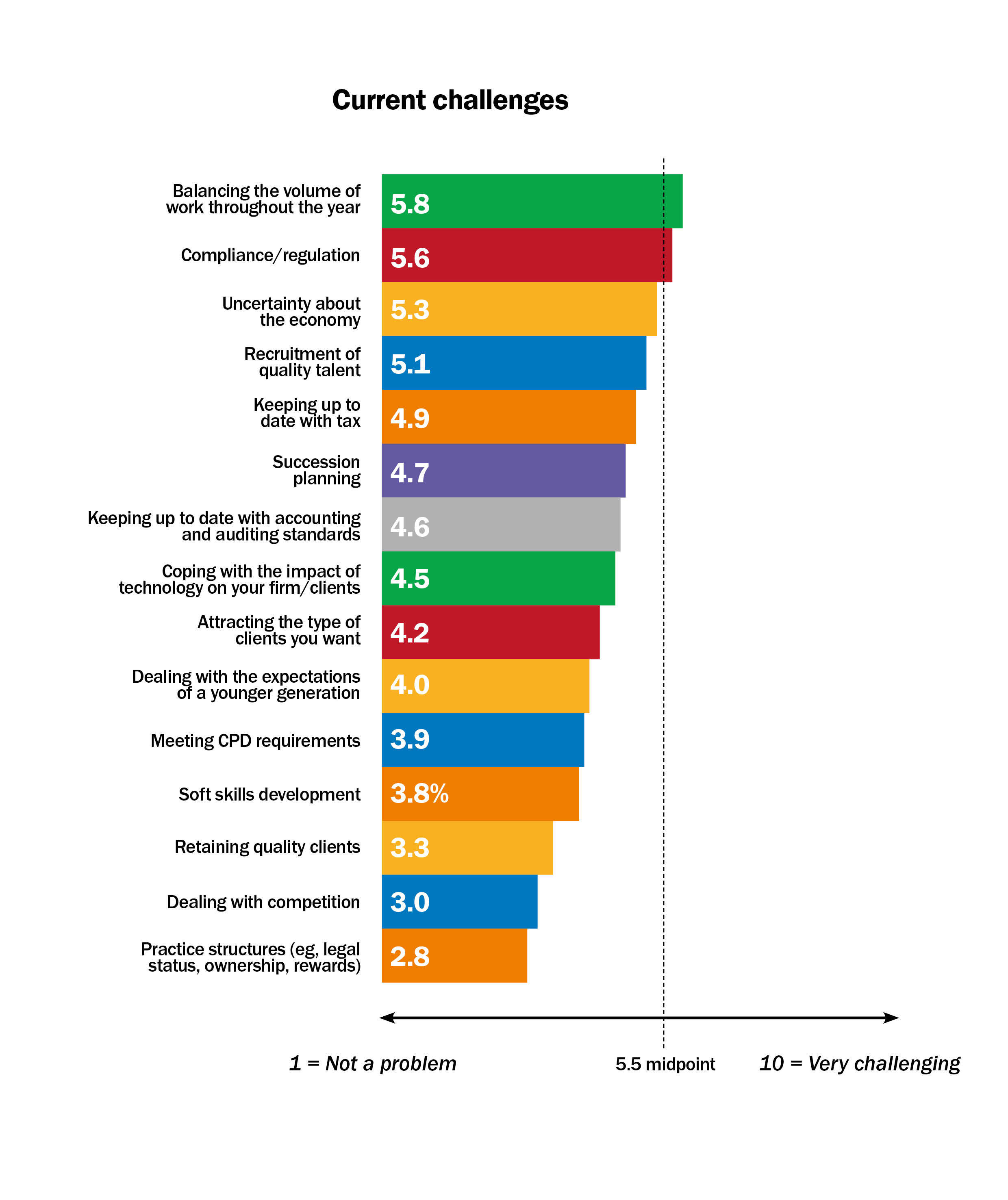

The top five challenges for the year ahead, on a scale of 1–10, were:

- Balancing the volume of work throughout the year – 5.8

- Compliance/regulation – 5.6

- Uncertainty about the economy – 5.3

- Recruitment of quality talent – 5.1

- Keeping up to date with tax – 4.9

It is worth noting, however, that the midpoint for this is 5.5. This means only the top two are considered by the majority of respondents to be an above-par challenge. This is virtually identical to our results from 2021, where the same two issues went above that 5.5 mark.

However, concerns around talent are significantly higher for firms with 10 or more partners (8.7) and, by some distance, their biggest concern, with the volume of work coming a distant second (6.7).

The key takeaway

It is reasonable to conclude that the tone is largely positive, especially if measured against broader UK business confidence, which is currently on the downslope. Then again, there are perhaps few professions better equipped for dealing with economic uncertainty than accountancy.

Accounting trends of 2022

Jo Copestake, UK Director of Accounting Partners at Xero

We know the importance of digital tools for practices and small businesses will only continue to increase, driven by everything from governmental schemes (such as Making Tax Digital) to changing consumer habits and ever more sophisticated digital tools. Last year, Xero’s Small Business Index report found that digital transformation is leading to significant benefits for SMEs, with those investing most in technology increasing their sales over those who spent the least. The industry will continue to be key in driving digital understanding and adoption among SMEs.

It’s not a new trend, but the role of accountants and bookkeepers in supporting small businesses will be more important than ever as we enter an extremely challenging period. The cost-of-living crisis, talent shortages and reduced consumer spending are all putting a squeeze on small businesses.

Our latest platform data shows that small business jobs fell by 5.3%, year on year, in August and sales remained flat. Accountants will be critical in guiding SMEs through these challenges and helping them find ways to grow.

One area that has been a big focus for us at Xero, and which is continuing to change the game for accountants, is automation. With automated end-to-end bookkeeping, tasks that used to take hours are completed in minutes, allowing firms to do more in less time. Being able to capture data more accurately from source documents, such as bills and receipts, means accountants and bookkeepers can import transaction data from bank accounts so clients are being paid as quickly as possible. In the coming months, we’ll see even greater adoption of automation-driven tools that help give practices an edge.

Finally, supporting wellbeing will continue to be key in practices. With the current economic turmoil and the lingering effects of a global pandemic, many will be feeling the pressures of work or running a business taking its toll on their wellbeing. Our research found that 82% of business owners said their mental health deteriorated over the pandemic. Putting a focus on mental health initiatives and building a culture with a strong sense of purpose will be even more important in the future – especially when it comes to attracting and retaining talent.

Standing firm

David Menzies CA, ICAS Director of Practice

The ICAS Practice Survey supported by Xero provides a fascinating insight into CA firms in 2022.

The survey was completed by CAs whose practice income ranged from £7,000–£55m. Some 91% operated in a firm with fewer than three principals and over 60% were sole practitioners. Average profitability per firm increased from 2021 by 25% to £342,000. This, though, masks that sole practitioners’ average profit fell marginally to £64,000 while the largest firms saw significant increases.

Over 70% of firms reported average debtor days of less than 45 days. Smaller firms continue to have greater control over working capital; 82% of sole practitioners have average debtor days of less than 45 (up from 75% in 2021), while 80% of four-to-nine-partner firms are above 45. For most firms in the survey the average fee per client was between £500 and £1,500.

Despite the current recruitment market, staff costs as a percentage of turnover remain stable. Average charge-out rates have increased most noticeably at qualified and associate/manager level with an uplift of over 25%. Outside London, the overall blended hourly charge-out rate is consistent at £130–£140 per hour.

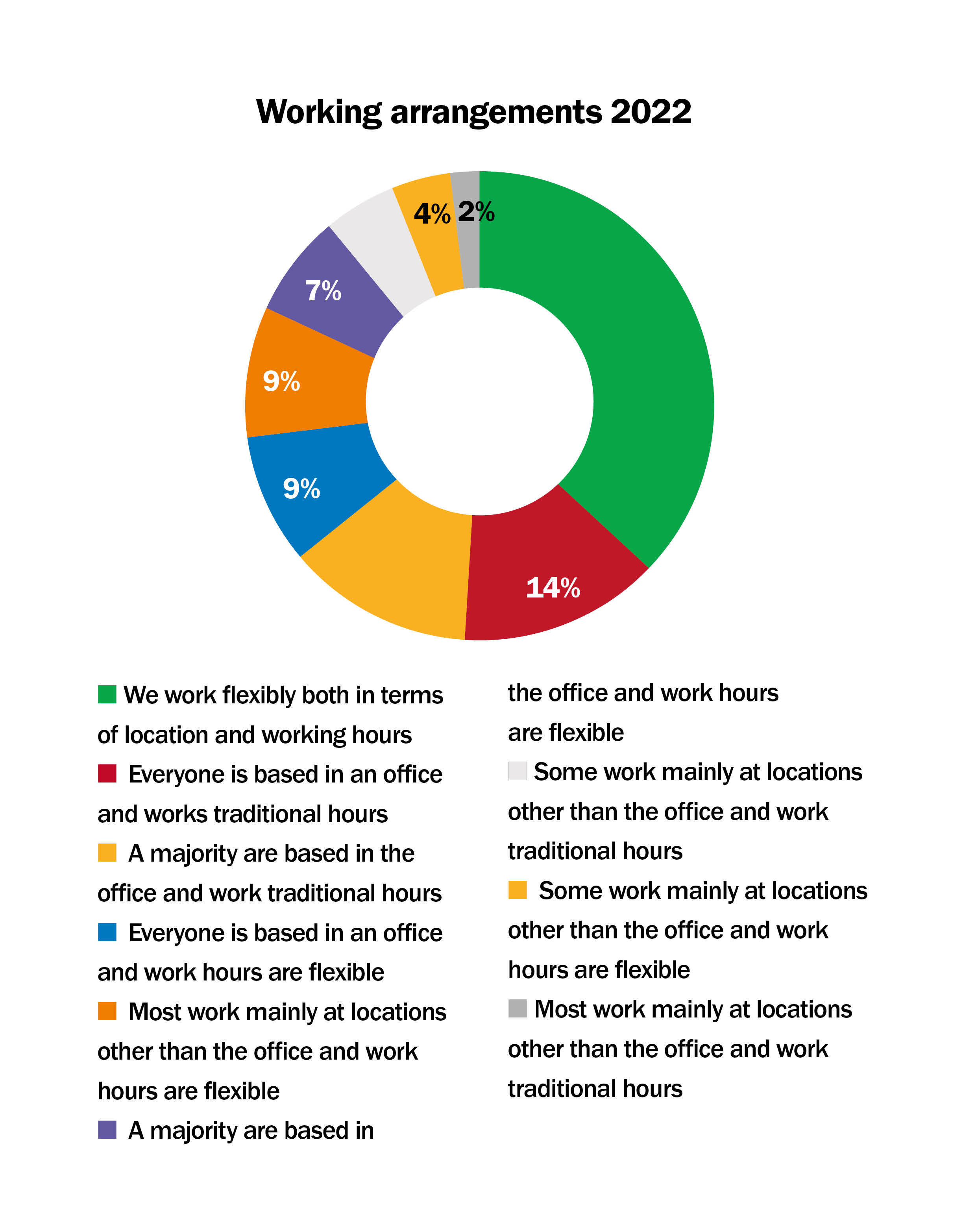

Firms have embraced the post-pandemic challenge of talent retention. Nearly 40% report working flexibly; only 14% are sticking to the traditional premises and working-hours model. Despite this, of firms that work from premises, 36% expect to renew the lease on their current premises and only 1% say they will downsize to smaller premises. Nearly a quarter however are undecided on their intentions.

Although sole practitioners and firms with fewer than 100 clients are least prepared for the introduction of MTD for ITSA, it is the larger firms that have not yet adopted MTD-compliant software. Given the current status of MTD for ITSA, perhaps none of this is too surprising.

Overall, the survey indicates the ICAS practice community are resilient and responsive to change. Underlying this is a multiplicity of performance, attitude to technology and demand for talent. The ICAS practice community is complex but also reassuringly stable, ensuring clients are supported in a way which is appropriate to them.

By CA magazine

By CA magazine