Why you should become an ICAS Chartered Accountant (CA)

Train to become a Chartered Accountant (CA) with ICAS for an exciting and rewarding career in business and beyond.

- qualify for more than accountancy

- wear the prestigious ‘CA’ badge

- unlock global opportunities

- competitive salaries and job security

- support from a professional network

Exceed beyond accountancy

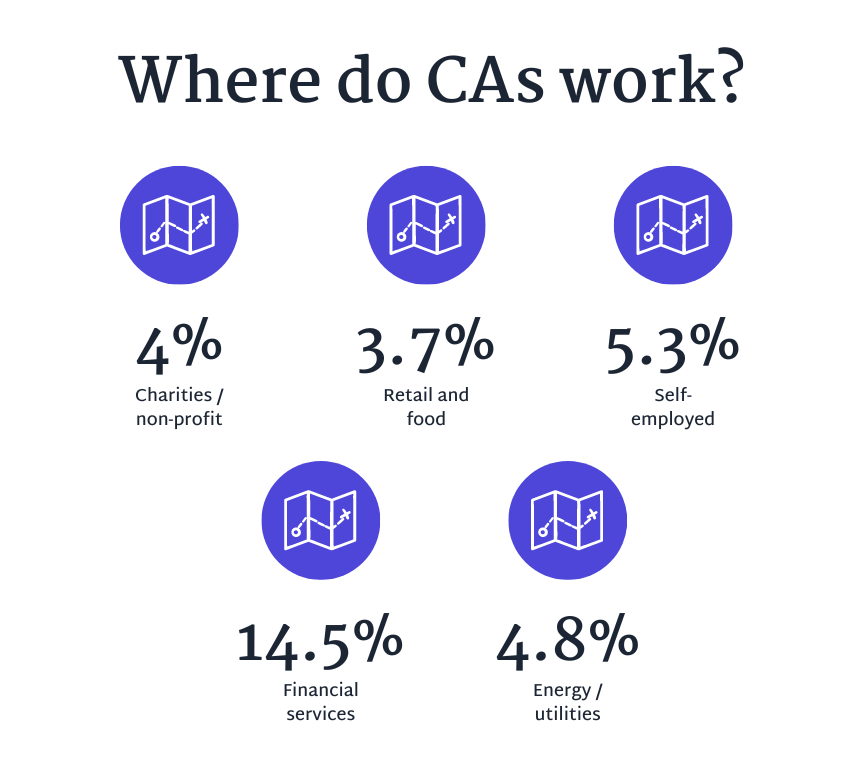

Chartered Accountants (CAs) don’t just work for accountancy firms. Qualify as an ICAS CA and the wealth of skills and expertise you gain will present a variety of impressive career opportunities.

The CA is a complete qualification from which you could go on to work at the highest levels of accountancy, finance and business, at a charity, government body or cutting-edge tech firm.

Furthermore, for those with an entrepreneurial streak, becoming a CA provides the key skills to start and manage a successful business.

- 83% of FTSE 100s employ CAs

- ICAS CAs work at senior levels such as CEO, CFO and board member

Start an extraordinary career – how to become a CA

CA – transform your life with two letters

The CA badge of Chartered Accountant is a sign of excellence that will impress employers and create opportunities throughout your career.

Becoming 'chartered' indicates that an accountant has reached the highest level, undertaken the ICAS programme of rigorous training and examinations in accountancy, business and ethics, and committed to a process of continuous professional development.

Having the letters CA of Chartered Accountant after your name will impress employers and open doors to a host of amazing life opportunities. And did you know, those two letters are exclusive to ICAS members? No other Institute, training body or organisation in the UK can use the prestigious CA designation.

A global opportunity

The ICAS CA is an internationally respected qualification that will provide extraordinary opportunities worldwide.

The CA designation is internationally renowned and valued, so you won’t be restricted to employment within the UK - in fact, as an ICAS Chartered Accountant, you could work anywhere in the world.

No matter where your travels lead, your skills as a dynamic, capable and forward-thinking business professional will always be in demand.

ICAS is also a member of Chartered Accountants Worldwide which brings together 14 of the world’s leading institutes of Chartered Accountants to form a global network with a combined total of 750,000 members across 190 countries.

Chartered Accountants are known globally as reliable, trusted voices and catalysts for change that help get businesses and economies moving again. Chartered Accountants are difference makers, in the contribution that they make in the organisations where they work, in communities, society and the wider economy.

ICAS has also developed several reciprocal agreements with international accounting bodies, further opening doors for CAs worldwide.

Start an extraordinary career – how to become a CA

Salary & security

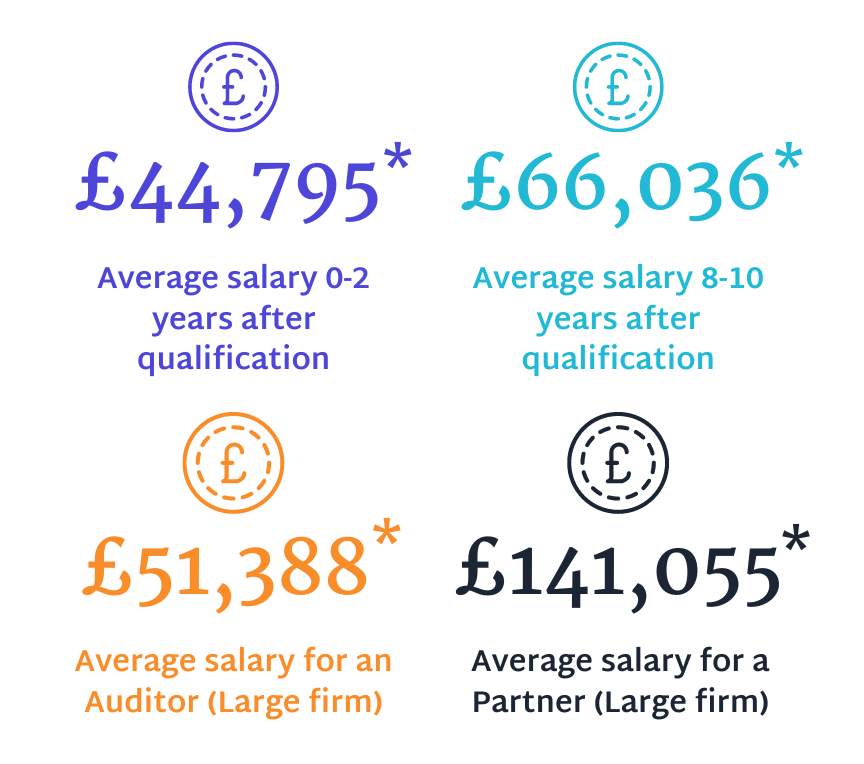

From training to qualification, CAs can expect a competitive salary in a profession with a bright and stable future.

Starting salaries for CAs compare favourably with those for sectors such as law, general management and banking. School leavers and graduates will receive a highly competitive salary whilst they train, as there will always be a demand for the skills of

CAs in business.

*Figures sourced from ICAS Salary Survey 2019.

Companies of all sizes will always need chartered accountants. Furthermore, the UK Commission for Employment and Skills listed chartered accountancy as one of the 40 most exciting and rewarding jobs that present a good mix of opportunity, reward, and long-term potential.

Training success

Our 160 years of professional experience have gone into delivering a system of first-class, fully supported education and a business qualification fit for the modern world.

The abundance of ICAS expertise forms the foundation of our unique syllabus, teaching materials and exams. Additionally, through regular employer consultation we keep the ICAS CA qualification, and our students’ knowledge, at the cutting edge.

Our hands-on approach combines expert tuition with practical application and will ease your understanding of complex financial activities. Ultimately, the technical expertise and professional skills gained whilst training with ICAS will form the basis of your successful career.

And our training track-record speaks for itself: some of the world’s most prominent and accomplished business leaders qualified as CAs with us.

International business class

The ICAS professional network continually works toward the success of its students and qualified members.

The incredible amount of hard work required to qualify is an experience shared by all Chartered Accountants and helps bring the 22,000 ICAS members together as a global business community. And at ICAS we continually work to foster those bonds, so you can easily learn from shared experience, build the knowledge and network required to progress.

Become an ICAS CA and you’ll receive unrivalled levels of professional support. We run a packed calendar of exciting events designed to connect and educate our members. You can network with like-minded colleagues at CA dinners worldwide, drop in to masterclasses on special-interest topics, attend speed-mentoring events, and view the latest exhibitions in some of the UK’s most exciting venues.

Start an extraordinary career – how to become a CA

FAQs

Why should I become a Chartered Accountant?

By training to become an ICAS Chartered Accountant (or CA for short), you’ll be on the fast track to unlock some of the most powerful and rewarding positions in business, accounting and industry, in the UK and internationally.

- Qualify for more than accountancy

- Use the prestigious CA letters after your name

- Unlock international opportunities

- Enjoy competitive salaries and job security

- Join a global business community

- Access ICAS’ unrivalled professional support

How is the ICAS CA qualification structured?

The ICAS CA is widely viewed as one of the most prestigious accounting qualifications in the world.

The CA syllabus begins with an Ethics module, which will be part of our Fundamentals onboarding course.

The remainder of the syllabus is structured over three levels, starting with Knowledge, leading to Skills, and finishing with Integration.

As illustrated below, the core subjects at the Skills level are supported by four new in-depth electives: Advanced Tax: Data Analytics; Innovation for Growth and Transformation; and Sustainability for Accountants.

Assessment is by examination (UK only) and, in addition, candidates must complete, and have validated, 450-750 days of relevant practical experience.

The qualification is credit rated at Level 11 on the Scottish Credit and Qualifications Framework (SCQF) and is recognised nationally and internationally as sitting at the level of a Masters degree.

Do I qualify for any exemptions to the CA qualification?

Exemptions may be available from all six papers of the Test of Competence (TC) level, depending on your qualifications and memberships.

Who may be eligible for an exemption?

- graduates with an ICAS-accredited degree

- graduates with some non-ICAS-accredited degrees

- members of ICAEW

- AAT Level 4 Diploma in Professional Accounting

Where do I apply for a CA training agreement?

Our dedicated job site Becomeaca.org.uk offers an interesting range of firms to work and train with, from small local companies to large corporations.

Can international students/graduates become a CA?

Yes, but it varies by employer. Students who need a visa to work in the UK, must check with the Authorised Training Office (ATO) to see whether this is possible with their individual employer.