Follow the graduate entry route and become a Chartered Accountant (CA)

The graduate route to becoming an ICAS Chartered Accountant enables students from a variety of backgrounds to train as a CA while earning a competitive salary.

Lots of our students come to us to train as CAs directly upon graduating from university.

They’re from a variety of backgrounds because it doesn’t matter what degree you have, and previous experience in accountancy or business isn’t required.

All you need is a university degree that meets the entry requirements, and the ambition to begin a truly extraordinary career.

Find a CA training vacancy that's right for you

What to expect

- takes approximately 3 years

- supported study

- a competitive salary

- detailed workplace experience

- a training vacancy that fits you

Three-years’ supported study

The graduate route to becoming a CA takes around three years. The qualification is rated at the same level as a master’s degree and is organised to cover everything from the essentials to advanced principles of accounting, business and ethics.

We’ll provide support throughout your studies, offering high-quality information, advice and guidance.

Relevant practical experience

To qualify as a CA, you’ll also need a minimum of 450 days of relevant practical experience. You’ll gain this by signing a training agreement and working with an ICAS-authorised employer – and earn a competitive salary whilst you learn.

A training vacancy to fit you

The range of available employers varies, from big accountancy firms and large corporations, to government offices, smaller start-ups and local companies, so you’re bound to find a training vacancy that fits you.

What’s required

- various degrees accepted

- international degrees also qualify

- meet the employer’s requirements

- course fees covered

Graduates with non-accountancy degrees

Most CA students hold non-accountancy degrees. With this type of degree, you won’t be eligible for exemptions and will begin at Test of Competence (TC), which provides the trainee CA with base concepts, knowledge and skills.

Graduates with ICAS-accredited degrees

If you graduated with an ICAS-accredited degree, you could be eligible for up to six exemptions from the first level of the CA qualification.

Graduates with non-UK degrees

ICAS welcomes international students holding degrees that are equivalent to a UK degree. There’s more information on our International Students page.

What’s next?

Apply for an ICAS CA training agreement

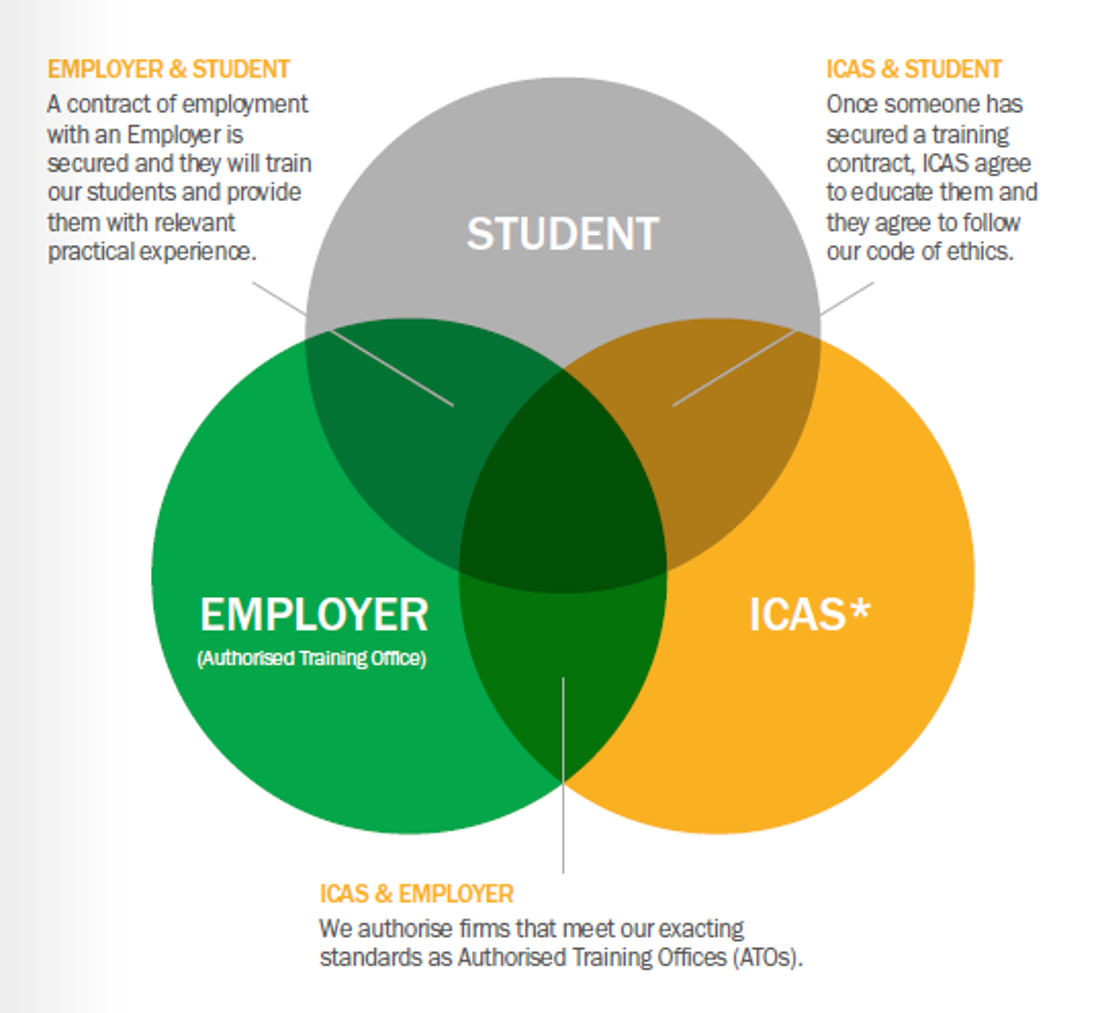

The first step to becoming a CA is to apply for a training agreement with an ICAS-authorised employer. Entry requirements vary per employer, and we offer a range of firms to work with, from small local companies to large corporations.

Find a CA training vacancy that's right for you

FAQs

Why should I become a Chartered Accountant?

By training to become an ICAS Chartered Accountant (or CA for short), you’ll be on the fast track to unlock some of the most powerful and rewarding positions in business, accounting and industry, in the UK and internationally.

- Qualify for more than accountancy

- Use the prestigious CA letters after your name

- Unlock international opportunities

- Enjoy competitive salaries and job security

- Join a global business community

- Access ICAS’ unrivalled professional support

Can international students/graduates become a CA?

Yes, but it varies by employer. Students who need a visa to work in the UK, must check with the Authorised Training Office (ATO) to see whether this is possible with their individual employer.

How is the ICAS CA qualification structured?

The ICAS CA is widely viewed as one of the most prestigious accounting qualifications in the world.

The CA syllabus begins with an Ethics module, which will be part of our Fundamentals onboarding course.

The remainder of the syllabus is structured over three levels, starting with Knowledge, leading to Skills, and finishing with Integration.

As illustrated below, the core subjects at the Skills level are supported by four new in-depth electives: Advanced Tax: Data Analytics; Innovation for Growth and Transformation; and Sustainability for Accountants.

Assessment is by examination (UK only) and, in addition, candidates must complete, and have validated, 450-750 days of relevant practical experience.

The qualification is credit rated at Level 11 on the Scottish Credit and Qualifications Framework (SCQF) and is recognised nationally and internationally as sitting at the level of a Masters degree.

Do I qualify for any exemptions to the CA qualification?

Exemptions may be available from all six papers of the Test of Competence (TC) level, depending on your qualifications and memberships.

Who may be eligible for an exemption?

- graduates with an ICAS-accredited degree

- graduates with some non-ICAS-accredited degrees

- members of ICAEW

- AAT Level 4 Diploma in Professional Accounting

Where do I apply for a CA training agreement?

Our dedicated job site Becomeaca.org.uk offers an interesting range of firms to work and train with, from small local companies to large corporations.

What are the other routes to becoming a Chartered Accountant?

There are various ways to become an ICAS Chartered Accountant (CA), with options for school leavers, graduates, professionals and apprentices: