TPS Risk & Technology

The TPS Risk & Technology (RT) course is the only fully online, self-directed TPS course on the CA Qualification.

Students will learn – through online, self-directed learning – vital new skills such as preparing, discussing and analysing large datasets and considering risk management.

Key themes of the course include:

- Business risks and risk monitoring

- Risk-management strategy

- Technology risk

- Data analysis and visualisation

- Automation

- New and disruptive technologies

- IT strategy

- Computational thinking

What makes RT different to the other TPS subjects?

Risk & Technology differs from the other TPS subjects in a number of ways:

- Taught via flexible bitesize learning

- Unique, fully online approach

- Co-developed with CA ANZ to share expertise

- Students will be equipped with an online Candidate Study Guide (CSG) which will be supplemented by e-learns, case studies, quizzes and video resources

- Using the study resources provided, Risk & Technology learning will be brought to life by use of real-world examples

How is RT assessed?

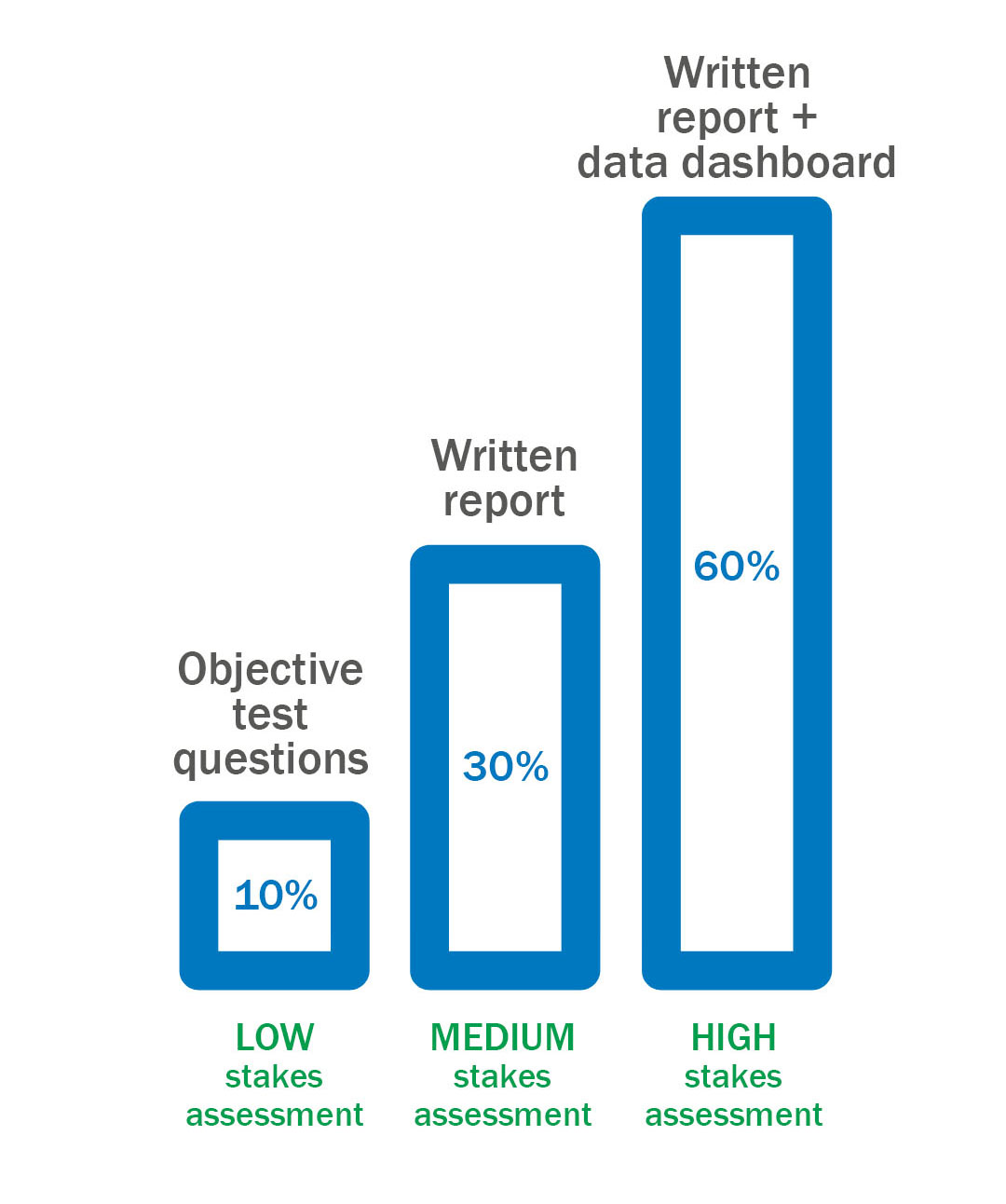

There is no final examination for Risk & Technology. This subject will be assessed through continual assessment, with incrementally rising stakes throughout (see diagram below).

Assessments are representative of real-life situations and Students will be required to respond to specific business scenarios.

Some key points to note about each assessment are as follows:

Assessment 1

- Students are issued a case study and resources in advance

- Assessment 1 comprises a series of 10 objective test questions (sat on demand)

- Assessment 1 focuses on the risk elements of the RT course

- Attempted after you've completed the first three days of learning

Assessment 2

- Students are issued a case study and resources in advance

- Students are required to produce a written report

- Assessment 2 features risk with elements of technology

- There will be fixed assessment release and submission dates for each RT diet

- Attempted after you've completed the first six days of learning

Assessment 3

- Students are issued a case study and resources in advance

- Students are required to produce a written report (including appendices and data dashboard)

- Assessment 3 includes all areas of the RT course

- There will be fixed assessment release and submission dates for each RT diet

- Attempted after you've completed all eight days of learning

The A1, A2 and A3 submission dates can be found in the RT Planner.

You don’t need to enrol in RT assessments. You’ll be automatically enrolled in Assessments 2 and 3 when you’ve submitted the previous assessment.

Important notice: All students registered to sit Risk & Technology must submit all three assessments during the same RT diet. If you do not submit all three assessments in the same RT diet, the assessments submitted will be void and you will be required to sit all three assessments in another diet.

Modular students should be given 8 days leave as a minimum and Block students should be given 3 days minimum.

What is the pass mark?

To pass Risk & Technology:

- 50% must be achieved (combined between Assessment 1, 2 and 3)

- If 50% is not achieved, all three assessments must be retaken in a separate diet

RT dates

Dates for the June, August and December RT courses are included in the RT Planner.

RT general guidance

An RT General Guidance document has been created for students, which includes information about learning resources and assessments.

Where you have completed the class and become exam-eligible for any old syllabus TPS subject, you are not required to sit RT, provided you pass all the remaining TPS subjects no later than the exam diet to December 2023.