Financial Accounting: What’s the DEAL/CLIP with Debits and Credits?

Lecturer and Financial Accounting Subject Controller, Heather McNellis CA, explores debits and credits within Financial Accounting.

The language of business

Accounting is often referred to as the language of business and if you want to understand it, you need to be able to speak “Debits and Credits”.

Debit is often shortened to ‘Dr’ and credit is shortened to ‘Cr’ – no-one is really sure why these abbreviations exist but it has been suggested that it comes from the Latin words debere (to owe) and credere (to entrust).

One of the fundamental features of accounting is that every transaction has a dual effect. This means that Debits and Credits will both be equally affected by any given transaction. Everything must balance!

Nominal ledger accounts

When a company is managing its accounts, it will create separate ‘nominal ledger’ accounts where the details of the financial transactions which have taken place are recorded.

Businesses will use a variety of nominal ledger accounts to record transactions. For example, if a business will have trade creditors, a ‘Trade creditors’ nominal ledger account will be needed. If it will incur an expense for heating and lighting, a ‘P&L – Heating and Lighting’ nominal ledger account will be needed. If it has motor vehicles, a ‘Motor Vehicles – cost’ and a ‘Motor Vehicles – accumulated depreciation’ nominal ledger accounts will be needed, etc.

The exact nominal ledger accounts used will vary between businesses and should be reviewed and amended as the business develops in order to continue to provide the most useful information to the business and to help make business decisions.

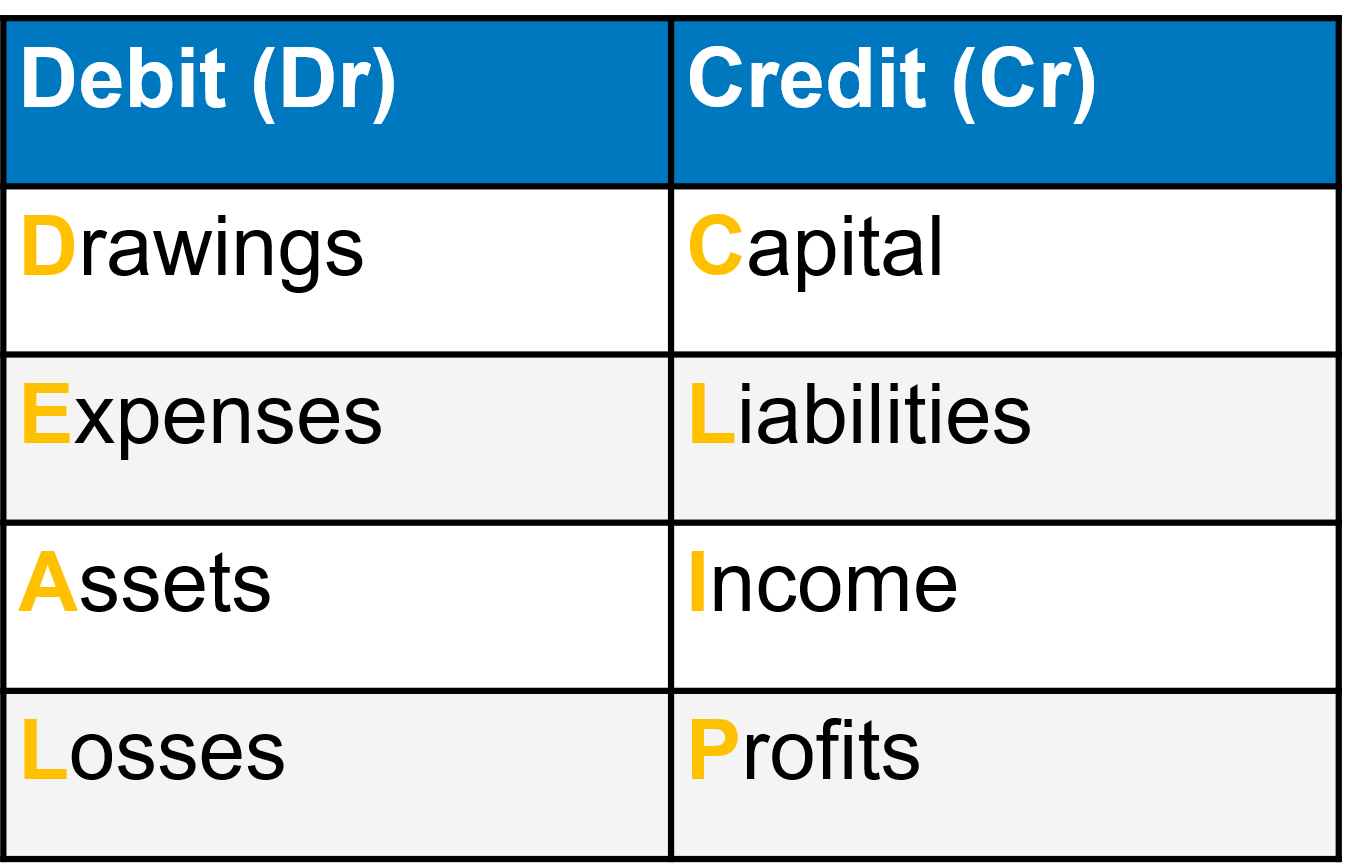

DEAL/CLIP

Each of these nominal ledger accounts could be described as being Debit or Credit in nature – and that’s where the DEAL/CLIP mnemonic comes in handy. It provides an easy way to remember whether a nominal ledger account is naturally Debit or Credit:

In order to record a transaction and show the movement within a nominal ledger account, journal entries must be processed.

To increase a Debit nominal ledger account, you have to Debit the account. To decrease it, you have to Credit it.

To increase a Credit nominal ledger account, you have to Credit the account. To decrease it, you have to Debit it.

DEAL/CLIP covers all the elements of financial statements:

- Assets, liabilities and equity (i.e. capital), which relate to a business’s financial position (i.e. its balance sheet); and

- Income and expenses, which relate to a business’s financial performance (i.e. its profit or loss).

Understanding the definitions of the elements of financial statements will help you to understand where a particular nominal ledger account will appear within the DEAL/CLIP mnemonic. It just takes practice!

How nominal ledger accounts fit into DEAL/CLIP

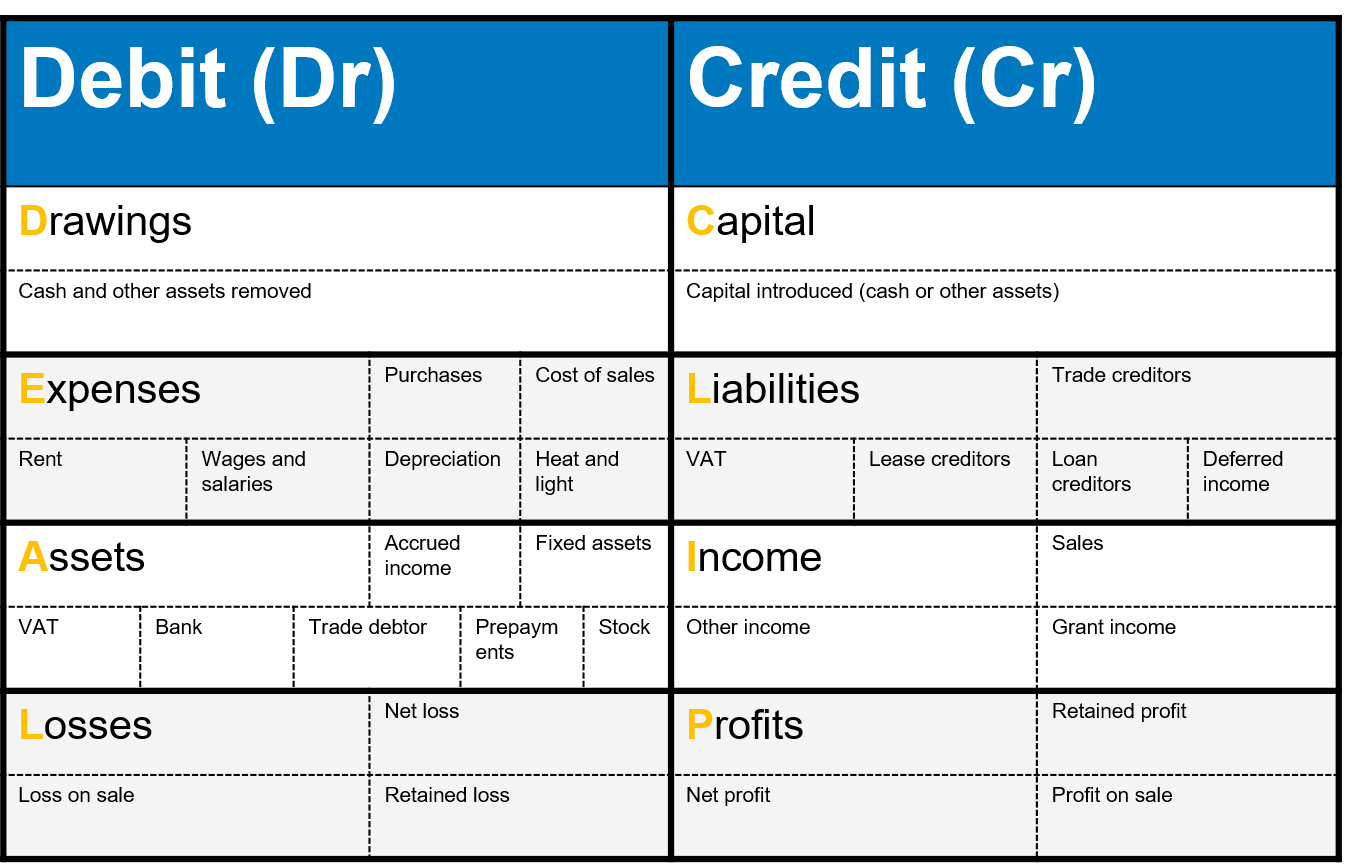

Eventually, you will start to get used to the types of account which are Debit or Credit in nature. To help you along though, here is a list of some common items and where they would appear within DEAL/CLIP:

In recent years, there has been a huge increase in the range and variety of accounting software available, including some well-known brands such as Xero, Sage and QuickBooks. Whether you work for a multinational company or are thinking of starting your own business (which may evolve into a multinational company one day), the fundamentals of Debits and Credits and DEAL/CLIP don’t change.

So, if you make sure you learn and understand DEAL/CLIP then that will help you on your way to being able to speak like an accountant!