Embracing technology and enhancing the value of the audit

In November 2017, ICAS and the Chartered Professional Accountants of Canada (CPA Canada) held their first joint symposium in Toronto.

A variety of stakeholders, including professional accounting bodies, educators, accounting firms, regulators, preparers, and those charged with governance, discussed and debated the future of the audit profession in the digital age and how technology might be used to enhance the audit.

Exactly one year later, on November 2, 2018, the dialogue resumed at a second symposium in Edinburgh to consider whether the same issues were still relevant.

The answer was yes...perhaps even more so.

Led by two expert panels, an audience of auditors, academics, preparers, standard-setters, and educators shared their views on two key issues affecting the assurance profession:

- the impact of technology on what is audited and the way the audit is performed; and

- the provision of assurance over information beyond traditional financial statements.

Views on advances in technology

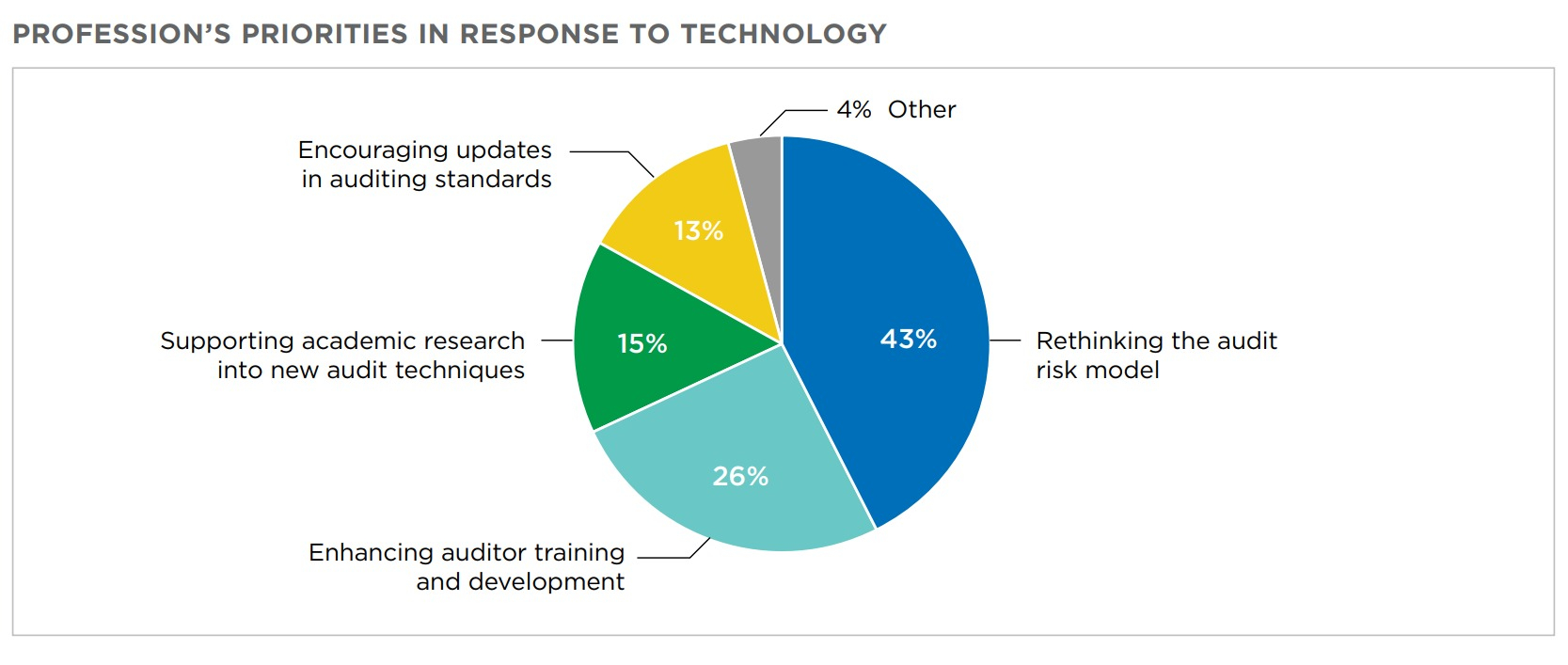

Attendees were invited, via an online polling system, to vote on how these key issues were likely to impact upon them. For example, Symposium participants shared their thoughts on the top priority for the profession in responding to advances in technology at audit clients. The responses are illustrated in the chart below:

Five calls to action

The key messages from the Edinburgh symposium have been summarised in a new report which reinforces the same five critical calls to action identified in Toronto.

- Innovate - The dynamic business environment, developments in technology and artificial intelligence (AI) represent an opportunity for the profession to innovate and identify the services and activities that best meet their clients’ and investors’ needs. We need to grasp this opportunity.

- Collaborate - There is a need for all parties: professional bodies, standard-setters, regulators and the firms; to collaborate and share resources, money, time and expertise to support and create agile, efficient, technology-enabled audit and assurance services.

- Educate - The professional bodies’ education programs need to ensure that people are being trained in the right skills and with the right mindset and reflect that lifelong learning and adaptability are now the norm.

- Adapt - There will be a greater need for multi-disciplinary engagement teams, for auditors to enhance their knowledge base beyond audit and accounting and to acquire new skills related to technology. Being able to adapt in this rapidly changing world is critical to success. We can’t just embrace change, we need to be change-makers; we need to remain nimble to near-term changes while taking a long-term outlook.

- Experiment - We should follow the example of other experimental initiatives, such as experimenting with how to value natural capital, human capital and social capital in addition to the more familiar financial capital, to develop a framework that results in the generation of decision-useful, credible information. Only by doing so, can audit and assurance continue to play a pivotal role in society.

These will be the key to navigating a business environment where disruption and rapid change are the new normal and ensuring the continued value and relevance of the role of audit and assurance.

By Anne Adrain, Head of Sustainability & Assurance

By Anne Adrain, Head of Sustainability & Assurance