SDG 8 Under the CA Spotlight: Economic Growth and ‘Industry 4.0'

The United Nations Sustainable Development Goals (“SDG’s”) aim to create a better, more sustainable world for future generations. Set in 2015 by the 2030 Agenda for Sustainable Development, they represent an urgent call for action, and have been adopted by all United Nations Member States.

But even the optimists amongst us would agree this sounds like a daunting, almost impossible, task. And besides, is this even relevant to the accountancy profession? How could one CA possibly help make a dent in this colossal aim? And, where would one start if they wanted to? The answers to these questions are perhaps more obvious than you’d initially think.

Take SDG 8: ‘Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all’. At its core, this feels like accountancy bread and butter. As a profession we have the skill set to advise our organisations and those around us on efficiency and effectiveness, getting the best out of our resources and future proofing business models and plans.

Let’s start with why this is an SDG. According to the UN, ‘Roughly half the world’s population still lives on the equivalent of about US$2 a day … and having a job doesn’t guarantee the ability to escape from poverty in many places’[1].

But this isn’t about simply boosting GDP per capita and reducing unemployment. It’s about creating decent, secure work for all, improving working conditions, and ensuring equality across the whole working age population. All whilst trying to limit damage to the environment we live in.

How can CAs help?

To understand how CAs can help achieve this let’s take a closer look at some of SDG 8’s twelve targets, in particular, those focusing on innovation and harnessing technological change:

- Achieve higher levels of economic productivity through diversification, technological upgrading and innovation;

- Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation[2].

Innovation and harnessing technological change tend to go hand in hand with economic growth so you can understand why SDG 8 would include both within its targets but is innovation stimulated? According to Tom Nicholas of Harvard Business School[3], ‘The idea that innovation drives economic growth is incontrovertible, but the factors that, in turn, drive innovation are not fully understood.’ One belief is that prosperity is a key driver of innovation. For example, the replacement of simple tasks by machines frees up time for us to do more ‘value add’ tasks, thus improving productivity and ultimately increasing overall levels of prosperity – it’s, therefore, a natural desire to want to innovate, in order to make things more efficient and easier to do.

Another view is that financial incentives aimed towards innovation allow organisations and entrepreneurs the opportunity to think more creatively in their problem-solving. Indeed within the UK Government’s Industrial Strategy, one of the foundations of productivity is ‘Ideas’ and a key policy is a long-term commitment to research and development (“R&D”), with an ambition to raise R&D investment to 2.4% of GDP by 2027, as well as increasing the R&D tax credit in 2017 to 12%.

CAs in the UK are working in one of the most innovative countries in the world – an ‘innovation leader’ in the 2018 European Innovation Scoreboard[4] and so should expect significant innovative technological change to start happening around them.

What technological change might be on the horizon?

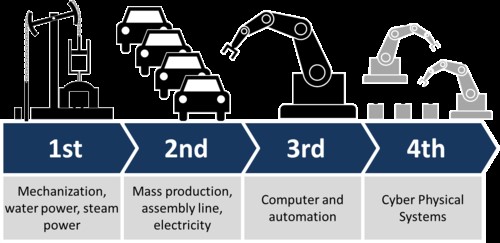

Many claim it’s already upon us and we’re on the cusp of what many describe as the 4th Industrial Revolution, or more simply: ‘Industry 4.0’.

Figure 1: Industrial Revolutions[5]

Part of Industry 4.0 is Artificial Intelligence (“AI”). By understanding and embracing the technology that AI harnesses, CAs can become even more valuable to the organisation’s they serve whilst reducing or removing altogether, the more mundane tasks such as data entry and manual checks. For example, in 2016, McKinsey suggested up to ‘86% of an accountant’s role could be automated’.[6]

This shouldn’t be something for CAs to fear but should be perceived as an opportunity to make a greater impact to the organisations they work within. It means CAs will have more time to work on adding value to their clients, as long their skills remain relevant and up to date. Its likely CAs will be expected to be more forward-looking - providing greater insight to senior leaders, and not simply relaying financial information and analysis. CAs will become even more integral to strategic decision-making, playing a bigger part in driving the agenda.

However, AI does not come without its risks, particularly within the context of SDG 8. Some job types are at greater risk than others of being replaced by AI and it cannot be ignored that those more likely to be affected will be performed by low skilled, lower wage workers.

Perhaps more worryingly for some are the potential ethical implications of AI. What if humans’ own biases, conscious or otherwise, are inadvertently built into AI-based decision-making systems? In that case, AI would be inherently flawed and even exacerbate inequality within society. It is on this basis that there is a call for good governance, transparency and accountability of AI; this is where CAs may truly come into their own, drawing on the skills that ICAS teaches on professionalism and ethics. The CA qualification gives a solid foundation in what makes a robust Controls Framework, what governance best practice looks like and how to successfully mitigate and manage risk. ICAS’ ‘The Power of One’ commits its members to conducting themselves with ‘integrity, objectivity and courage’ - characteristics all vital for ensuring that transparency and accountability standards are adhered to.

Innovation in AI is here to stay and happening at a rapid pace and no doubt has the ability to catapult us towards achieving SDG 8. But it is not without it’s risks. It is up to CAs to ensure we understand how AI can help our organisations to grow and become more productive. It is also up to CAs to utilise the ethical skills that we have learned – to ensure technological advancement is not at the detriment of our workers, nor to society’s success.

So, whilst the overarching aim of the UN’s SDG’s is ambitious, by breaking down each into its respective goals and thinking more specifically about individual targets, maybe as CAs we can make that dent after all.

[1] & [2] https://www.un.org/sustainabledevelopment/economic-growth/

[3] https://www.hbs.edu/faculty/Pages/item.aspx?num=38839

[4] http://ec.europa.eu/growth/industry/innovation/facts-figures/scoreboards_en

[5] Christoph Roser at AllAboutLean.com. - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=47640595

By ICAS Sustainability Panel member Meg Burns CA

By ICAS Sustainability Panel member Meg Burns CA