Clare Campbell CA: How you can turn your creative passion into a serious business

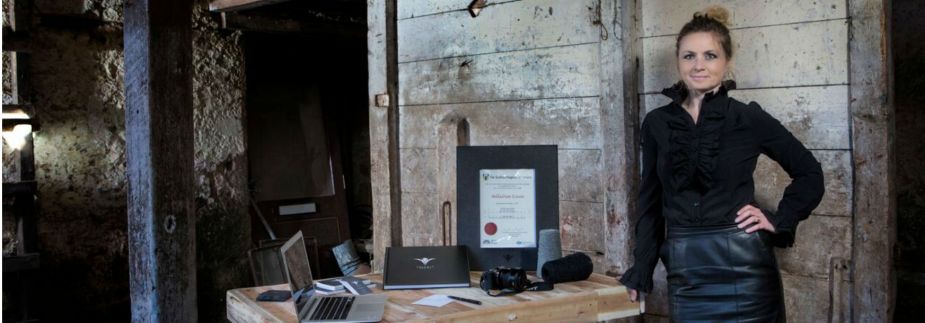

Clare Campbell is making waves with Prickly Thistle, the bespoke tartan start-up revitalising a traditional Scottish craft.

So far, she’s created unique designs for a varied client base, from Skyscanner to Tomatin Distillery. But what led her to leave behind a successful career as a chartered accountant and start her own business in a more creative field?

“I’ve always been obsessed with tartan’s simple beauty and storytelling ability,” says Clare. “And for me it was time there was a single malt for the textile industry.”

Yet it was when Clare saw the commercial opportunity in modernising and personalising this traditional fabric that she really focused on the possibility of making a living from it. Having advised others for so long, she decided it was time to follow her own passions and launch her own business.

Balancing creativity with due diligence

Making the leap obviously meant taking risks, but Clare says her training as an accountant helped her think clearly. She wouldn’t, for instance, go all in and mortgage the family house.

“When it’s a financial decision, you don't react based on what it only means today,” says Clare. “You ask yourself, if I do this today what does that mean in 10 years and 20 years?” She may be a business owner and entrepreneur but emphasises that she is also a wife and a mother. She is proof that start-up founders don’t need to go all in or take unnecessary risks.

Taking a more conservative approach to building her business has meant a little more creative thinking was needed – be that by cutting down on accommodation costs by spending the night at an airport Starbucks, finding unconventional sources of funding, or creating grassroots communities around her product.

What did it for me was playing it forward 20 years from now and thinking, what will I regret?”

While many wouldn’t expect a chartered accountant to lead a radical creative endeavour, Clare’s previous experience in advising everyone from local start-ups to global corporations gave her the tools she needed to mould her vision into a functioning business.

“You need a commercially-minded person to tell you how to run a start-up,” Clare says. “Someone who understands business realities and processes.”

Planning for challenges, both short and long-term

The first challenge facing Clare was a familiar one for entrepreneurs; the blessing and curse of being first to market. She knew from the beginning that education – both of potential investors and customers – would be an integral part of her strategy. She also understood that being first meant looking far into the future and setting herself up for competition in the next ten years.

This long-term planning had a personal element to it as well. Knowing how easy it can be to get caught up in passion projects, she started with an honest analysis of the risks and drew a line in the sand in terms of how much she was willing to commit to this dream. “If I don’t get to a certain stage by a certain point in time, I know it’s time to move on.” Setting clear goals for herself, she believes, keeps emotions out of investment decisions and keeps her aware of what matters most.

Clare has also had to deal with being an outsider in a very traditional industry. She is, in fact, the first ever woman to build a tartan specialist weaving mill in Scotland. “People tend to think, that's a job for a man and that's a job for a woman. But if you're capable of doing it then you should be respected for your vision and for your abilities.” She knows things can get very tough and recommends a high reserve of tenacity and a belief that good things will come.

The right time is up to you

Clare doesn’t believe there’s a right window to make big career changes and doesn’t buy into the idea that it’s too late if you’re over 30. She herself waited for her children to grow up before becoming an entrepreneur. All that matters is thinking long-term and not denying yourself the opportunity if you believe the time is right. “What did it for me was playing it forward 20 years from now and thinking, what will I regret?”

Asking ‘what’s the worst that could happen’ has both helped inform and motivate Clare. As long as she can live with the answer to that question, she’ll go for it. Thanks to a strong foundation as a chartered accountant to fall back on, she knows she can dare to be bold and follow her passion.

This blog is one of a series of articles from our commercial partners.

The views expressed are those of the author and not necessarily those of ICAS.